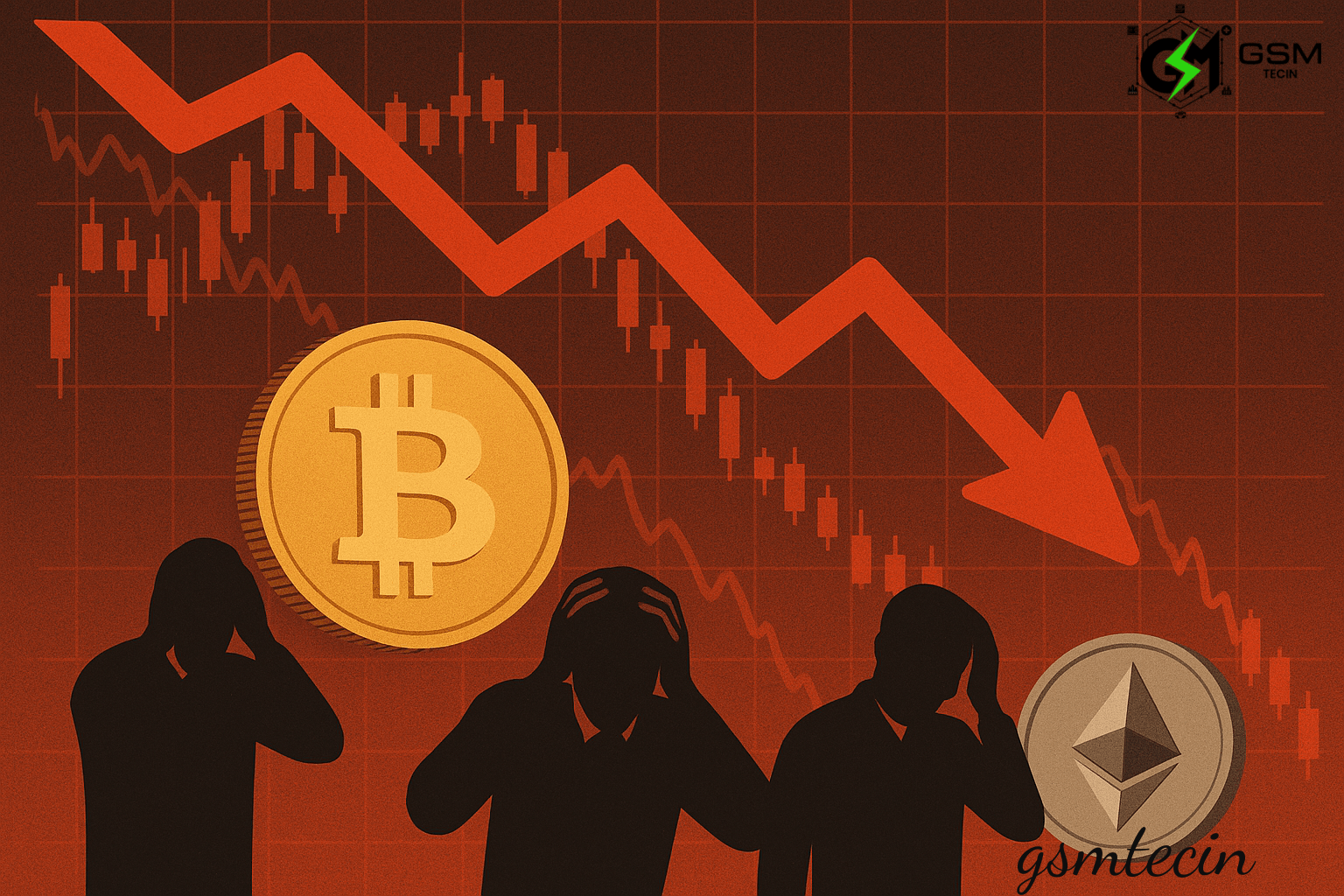

A $1 billion cryptocurrency liquidation causes a significant market sell-off. What transpired and what comes next?

More than $1 billion in leveraged positions were liquidated in a matter of hours, causing a sharp and widespread sell-off across major digital assets, resulting in one of the cryptocurrency market’s most dramatic declines of the year. The event led to panic selling on leading centralised and decentralised exchanges, quickly erasing long positions and raising renewed concerns about the role of excessive leverage in crypto markets.

The Liquidation Cascade: What Caused It?

A number of factors that came together nearly at the same time drove the sell-off:

Growing macroeconomic and geopolitical unpredictability

Due to worries about inflation and the uncertainty surrounding impending central bank decisions, global risk sentiment had already deteriorated, causing cryptocurrency to move in tandem with falling equity markets.

Severe over-leveraging at market highs

Traders had accumulated aggressive long positions in anticipation of a price breakout. Leveraged positions started to hit forced liquidation zones when prices slightly declined, generating downward momentum.

Algorithmic triggers and stop-loss

Automated trading systems increased volatility and liquidations sparked additional sell orders, transforming a typical correction into a sharp, abrupt sell-off.

Which Tokens Were Hit the Most?

Nearly the entire crypto market declined, but losses were most severe in:

| Cryptocurrency | Impact |

|---|---|

| Bitcoin (BTC) | Over half of liquidations were BTC long positions |

| Ethereum (ETH) | Second-largest liquidations, especially on futures markets |

| Solana (SOL) | High volatility due to speculative leverage |

| Altcoins | Double-digit drops due to lower liquidity and panic exits |

Long positions accounted for over 80% of liquidations, indicating that traders were primarily wagering on price increases rather than getting ready for a decline.

Exchange Pressure and Network Effects

The shock wave was felt across both CEXs and DEXs, including Binance, OKX, Bybit, Deribit, and dYdX. As liquidation volumes spiked, trading volume surged, gas fees on Ethereum briefly increased, and several altcoin markets experienced heightened slippage.

Investors Shift from Greed to Fear

The Crypto Fear & Greed Index rapidly shifted from Greed to Fear, and social sentiment reflected high levels of panic among short-term traders. However, on-chain activity showed that long-term holders remained relatively steady, with few selling coins held for six months or more. Leveraged traders are more negatively impacted by volatility than long-term market participants.

Additional Bloomberg Insights

Late on 1 December (IST), close to $1 billion in leveraged bets were liquidated, with Bitcoin briefly dropping 8% to $83,824 before recovering slightly to $86,719. Bitcoin has now fallen nearly 30% from its October peak of $126,000. Smaller tokens suffered even more, with the bottom half of the top 100 digital assets down almost 70% this year. Ethereum fell as much as 10% to $2,719.

Analysts noted that crypto markets were already fragile following the $19 billion liquidation event in early October when President Donald Trump’s tariff announcements shook global markets, causing major liquidation cascades just days after Bitcoin set its all-time high.

The Significance of Liquidation Data

Liquidation statistics are used to gauge speculative exposure and risk appetite across the market. However, industry insiders caution that exchanges often do not share complete liquidation figures, meaning the true leverage in the system may be much higher than estimated.

Commentary on the Market

Sean McNulty of FalconX described the environment as a “risk-off start to December”, pointing to weak Bitcoin ETF inflows and the absence of dip buyers. The next crucial Bitcoin support level, according to analysts, is $80,000. Macroeconomic uncertainty is also affecting sentiment as global markets brace for upcoming central bank decisions, including expectations of Fed rate cuts and Japan’s potential rate hikes.

Pressure on Institutional Players

Michael Saylor’s Strategy Inc. announced a $1.4 billion reserve to cover dividend and interest payments amid fears that continued price declines could force the company to sell part of its $56 billion Bitcoin portfolio. The company’s stock fell more than 10% and is currently 66% below its peak in November 2024.

ETF Inflows and Global Policy

After $4.6 billion in withdrawals over the previous month, U.S. spot Bitcoin ETFs saw modest inflows of $70 million last week. In the meantime, S&P downgraded USDT’s stability rating due to the possibility of undercollateralization if the price of Bitcoin keeps declining. A warning about stablecoins and illicit cryptocurrency activity was also released by China’s central bank.

What Will Happen Next?

Some analysts see signs of a possible recovery despite the unrest. Flowdesk’s Karim Dandashy said a year-end rally remains possible if economic data supports expectations of continued monetary easing.

Conclusion

The structural risk of excessive leverage in cryptocurrency markets is highlighted by the most recent liquidation event. Although unpleasant, the purge has decreased open interest, reset funding rates, and decreased speculation conditions that typically precede stabilisation and, in certain situations, renewed upside momentum. The crypto market isn’t collapsing; it’s rebalancing after an overheated leverage cycle, positioned for a cautiously optimistic rebound depending on macroeconomic trends.