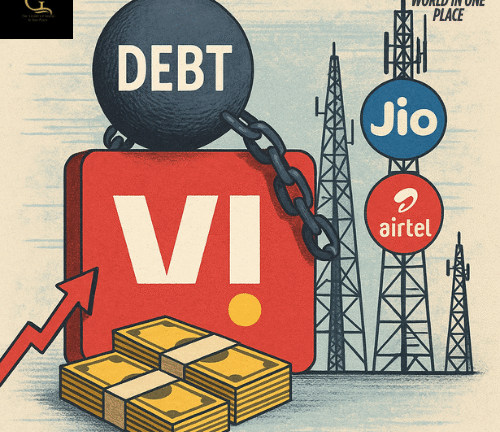

Vodafone Idea’s Struggle Deepens Due to Urgent Need for Funding and Relief

New Delhi, June 2, 2025— Vodafone Idea Ltd (Vi), India’s third-largest telecom provider, is in dire financial straits and is urgently seeking government assistance as well as debt finance from banks in order to continue operations. The company’s future depends on securing a critical ₹25,000 crore funding package — ₹15,000 crore from potential investors and ₹10,000 crore in bank credit — as it attempts to ramp up 5G deployment, strengthen its balance sheet, and retain its subscriber base against stiff competition from Reliance Jio and Bharti Airtel.

History of Persistent Difficulties

Vi, which was created by the 2018 merger of Idea Cellular and Vodafone India, has long struggled financially as a result of growing regulatory obligations, dwindling market share, and excessive debt. With about ₹83,400 crore in adjusted gross revenue (AGR) dues alone, their gross debt as of March 2025 is over ₹2.1 lakh crore. Vi’s financial limitations were not alleviated by the government’s 2023 conversion of some of this debt into equity, which resulted in a 33% ownership.

Funding Dependent on Bank and Government Assistance

Vi is negotiating with overseas investors, such as sovereign wealth funds and private equity firms, but firm promises are still scarce. Insiders claim that in the absence of obvious bank backing, investors are wary because they worry that their money would only be utilised to pay obligations. As equity investors look for guarantees of operating capital availability, Vi’s top management has informed the Department of Telecommunications (DoT) that new stock will only become available if banks consent to lend.

The business has already started talking to banks and government representatives about the potential for debt modification or partial guarantees. Banks are still apprehensive, though, until it is clear how Vi’s regulatory obligations will be handled.

AGR Obligations and Legal Repercussions

On May 19, the Supreme Court denied Vi’s recent request to waive ₹45,000 crore in interest and penalties on AGR dues. Despite the court’s observation that it would not prevent the government from offering remedy, this was left unclear in the subsequent written order. The current moratorium expires in September, and Vi will have to pay about ₹18,000 crore a year for six years starting in March 2026 in order to pay AGR and spectrum dues.

5G Rollout and Capex Depend on Funding

Vi’s delayed 5G rollout is starting to pose a significant threat to its competitiveness. Due to a lack of funding, it hasn’t deployed services at scale even though it purchased 5G spectrum in 2022. Vi could lose its premium consumers if Jio and Airtel grow rapidly. For the first half of FY26, the business intends to invest between ₹5,000 and 6,000 crore in capital expenditures, primarily to extend 4G and get ready for 5G. However, additional investment is subject on bank financing.

Vi is now on pace with its 6,000 crore capital expenditure target for the current quarter, according to CEO Akshaya Moondra. 4G population coverage is expected to increase from 83% to 84% and then to 90%, depending on funding availability.

Concerns about Industry Tariffs and Equity Raising

Vi’s board authorised a new 20,000 crore equity issue either a private placement or public offering on 30 May. But previous fundraising initiatives have been continually postponed. Moondra has also stated that the current data pricing is unsustainable and that industry-wide tariff hikes are necessary to boost return on capital.

A Financial Overview and Market Patterns

Higher loan charges, which made up almost 60% of Vi’s operating revenue, caused its net loss to increase to ₹7,166 crore in Q4 FY25. Due to subscriber loss, particularly at the lower end, revenue decreased 1% sequentially even though it increased 4% year over year to ₹11,014 crore. With 198.2 million customers overall, subscription churn decreased to 1.6 million in the March quarter.

Company leaders are cautiously optimistic despite the terrible circumstances. Moondra reaffirmed Vi’s dedication to clients and digital growth, emphasising that talks with banks will start up again in earnest as soon as the present prerequisites are satisfied.

Conclusion: A Tipping Point

Vi’s survival now depends on urgent coordination between banks, government bodies, and investors. Without relief and bank credit, the company’s ability to sustain operations and invest in 5G is under serious threat. The next few weeks will be decisive — they could either mark the beginning of a recovery or signal a further downward spiral for India’s most fragile telecom player.