Volvo Cars, Owned by Chinese Firm Geely, to Cut 3,000 Jobs Amid Industry Turmoil

Volvo Cars, the iconic Swedish automaker now under the ownership of China’s Geely Holding Group, has announced it will cut approximately 3,000 jobs globally as part of a sweeping cost-reduction initiative. The decision comes amid intensifying industry challenges, including a costly shift to electric vehicles (EVs), economic uncertainty, and international trade pressures.

The layoffs will mainly affect office-based positions and administrative roles, particularly in Sweden, where Volvo is headquartered. The company says the cuts represent about 15% of its white-collar workforce and are aimed at enhancing operational efficiency during a period of major industrial transformation.

A Strategic Restructuring

In a statement, Volvo said the layoffs are part of an 18 billion Swedish kronor ($1.9 billion) “action plan” designed to streamline operations and prepare the company for a future dominated by electrification, digitalization, and global competition.

“Our industry is undergoing a seismic transformation, and we must continue to adapt to secure our future,” said Jim Rowan, Chief Executive Officer of Volvo Cars. “That means making some tough decisions now to ensure we remain competitive, agile, and well-positioned for the challenges ahead.”

Although Volvo did not provide a full country-by-country breakdown of the job losses, sources indicate that operations in both Europe and North America will be affected. The company currently employs around 43,000 people globally.

EV Transition Proves Capital-Intensive

The layoffs come as Volvo accelerates its transition to becoming a fully electric car manufacturer by 2030. In 2021, the company announced its intention to phase out all internal combustion engine (ICE) models in favor of battery electric vehicles (BEVs). However, this ambition has since been tempered due to economic constraints, supply chain instability, and tariffs targeting EV imports in various markets.

Last year, Volvo signaled a partial retreat from its all-electric goal, citing “additional uncertainties created by recent tariffs on EVs in various markets” and rising costs of raw materials like lithium and nickel.

“The shift to EVs requires huge investments in battery development, software systems, and new manufacturing platforms,” said Rowan. “We are not just competing on hardware anymore. We’re also competing on software, user experience, sustainability credentials, and cost-efficiency.”

Mounting Market Pressures

Volvo, sold by Ford Motor Company to Geely in 2010, has enjoyed years of relative autonomy under Chinese ownership, expanding globally and introducing popular SUV models like the XC60 and XC90. But like many global automakers, it is now under increased pressure to deliver returns amid slowing sales and rising interest rates.

The company recently reported that global vehicle sales for April were down 11% year-over-year, underlining the demand-side pressure automakers are grappling with. Inflation, high borrowing costs, and geopolitical tensions have also dampened consumer confidence, especially in key markets like Europe and China.

“It’s clear that Geely is looking to future-proof Volvo’s operations,” said Ingrid Martens, an analyst at Nordea Markets. “This kind of cost-cutting is painful but often necessary when the macroeconomic outlook is uncertain and the stakes of the EV transition are this high.”

A Broader Industry Shake-up

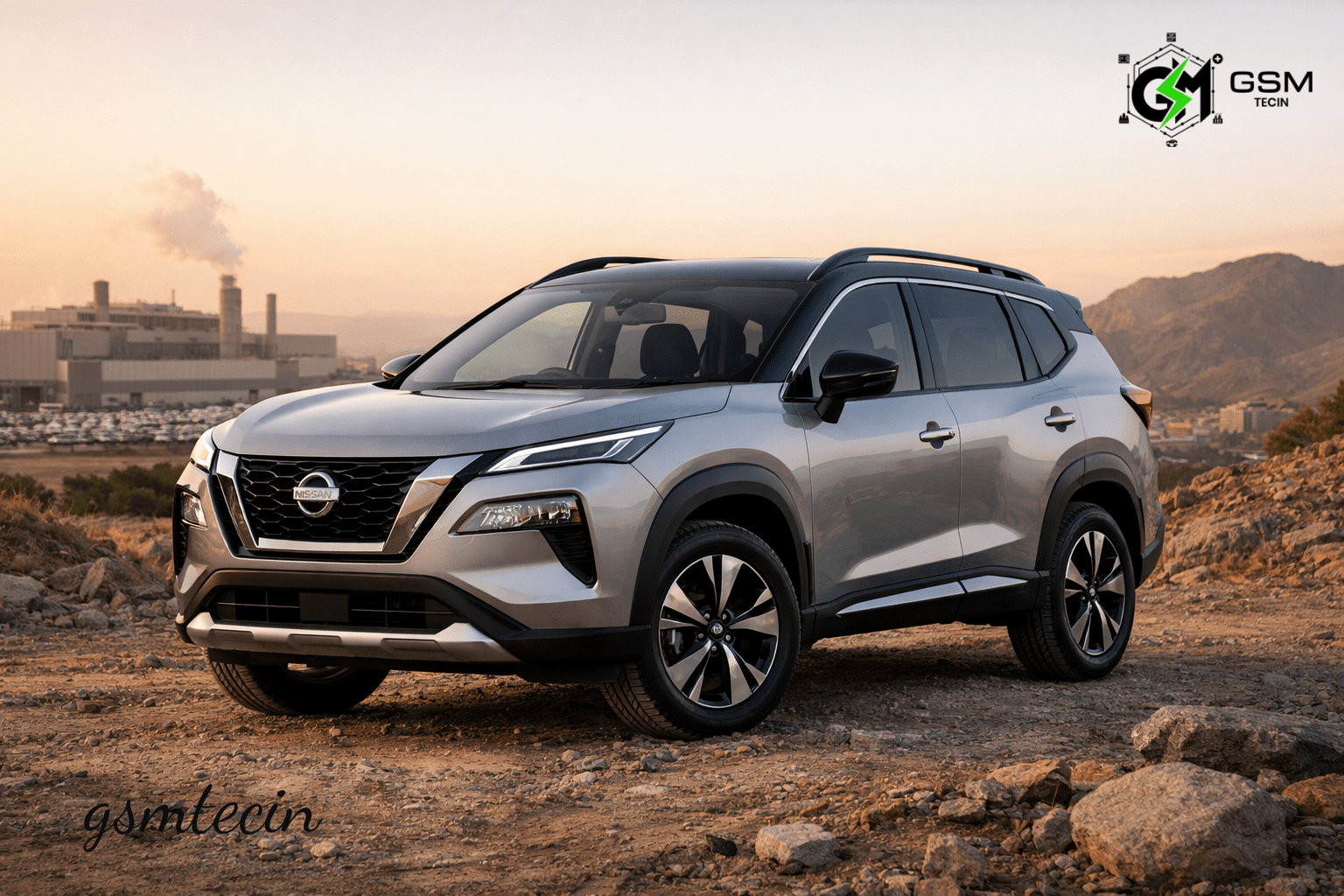

Volvo is not alone in its retrenchment. Other major automakers have similarly announced layoffs and restructuring measures in recent months. Japanese carmaker Nissan, for example, said it will cut 11,000 jobs globally and shut seven plants amid falling sales and failed merger talks. The total number of jobs Nissan plans to eliminate now stands at around 20,000—about 15% of its global workforce.

Meanwhile, EV competition is heating up, especially from Chinese firms. BYD, China’s top electric vehicle manufacturer, recently cut prices on over 20 models to maintain its edge, pushing the price of its cheapest car, the Seagull EV, to as low as 55,800 yuan ($7,745). The move prompted similar price cuts from competitors including Changan and Leapmotor, the latter backed by Stellantis.

In Europe, BYD even outsold Elon Musk’s Tesla in April, according to research from Jato Dynamics, signaling a shift in consumer preference and raising concerns for traditional automakers trying to hold their ground in the EV space.

Labor Concerns and Swedish Backlash

In Sweden, where Volvo has its main headquarters and development offices in Gothenburg, the job cuts have drawn sharp criticism from labor unions and worker advocates. The Swedish Metalworkers’ Union (IF Metall) expressed frustration at the company’s lack of consultation and called for more support for affected employees.

“We understand the need to adapt, but workers deserve clarity and fairness,” said Mikael Johansson, spokesperson for IF Metall. “Volvo has a responsibility to support those affected and to invest in reskilling programs wherever possible.”

Volvo has pledged to provide severance packages, career transition services, and retraining opportunities, especially in growth areas such as EV production, battery manufacturing, and software engineering.

Outlook: Pain Today, Promise Tomorrow

Despite the immediate pain, Volvo leadership remains optimistic about the company’s long-term direction. The automaker is pushing ahead with several new electric models, including the compact EX30 SUV and the flagship EX90, expected to reach markets later this year. It is also investing heavily in its own battery production capabilities and in proprietary software development to reduce dependency on external suppliers.

“Change is never easy, but it’s essential,” Rowan emphasized. “We remain committed to our people, our values, and our mission to create a safer, cleaner, and more sustainable future through mobility.”

As Volvo navigates one of the most turbulent periods in its century-long history, its success will likely depend on how well it can balance cost discipline with innovation, and how quickly it can adapt to an industry being reshaped by electrification, automation, and global realignment.